Understanding the cost of health insurance is crucial for individuals and families seeking to make informed decisions about their healthcare coverage. Health insurance premiums vary depending on factors such as age, location, type of coverage, and insurance provider.

Health insurance provides numerous benefits, including access to preventive care, coverage for medical expenses, and financial protection against unexpected healthcare costs. Historically, health insurance costs have been on the rise, driven by factors such as increasing healthcare costs, inflation, and changes in insurance regulations.

To delve deeper into the complexities of health insurance costs, let’s explore the various factors that influence premiums, analyze historical trends, and examine strategies for managing these costs effectively.

how much does health insurance cost

Determining the cost of health insurance is essential for financial planning and healthcare decision-making. Several key aspects influence health insurance premiums and overall expenses.

- Age: Premiums typically increase with age due to higher healthcare utilization.

- Location: Geographic location impacts insurance costs based on factors like healthcare provider availability and cost of living.

- Coverage: The type and extent of coverage, such as deductibles, copays, and coinsurance, affect premium costs.

- Provider: Different insurance providers offer varying premiums based on their administrative costs, provider networks, and profit margins.

- Health status: Pre-existing conditions or high-risk factors can lead to higher premiums.

- Employer contribution: For employer-sponsored plans, the employer’s contribution can significantly reduce the employee’s premium cost.

- Government subsidies: Government programs like Medicaid and Medicare can provide financial assistance to low-income individuals and families.

Understanding these key aspects empowers individuals to make informed decisions about their health insurance coverage. By considering factors such as age, location, and coverage options, individuals can optimize their healthcare expenses and secure appropriate protection against financial risks.

Age

This statement highlights a crucial factor influencing health insurance costs. As individuals age, they tend to utilize healthcare services more frequently. This increased utilization is primarily attributed to age-related health conditions, chronic illnesses, and preventive care. Consequently, insurance companies adjust premiums to reflect the higher healthcare costs associated with older individuals. Understanding this connection is vital for individuals planning for their healthcare expenses throughout their lifetime.

For instance, younger individuals may pay lower premiums due to their generally lower healthcare utilization. However, as they enter their middle age and beyond, premiums gradually increase to account for the anticipated rise in healthcare needs. This understanding allows individuals to budget and prepare for these increasing costs as they age.

Recognizing the impact of age on health insurance premiums empowers individuals to make informed decisions about their coverage and financial planning. By considering their age and anticipated healthcare needs, individuals can select appropriate coverage options and explore strategies to manage their healthcare expenses effectively.

Location

Location plays a significant role in determining health insurance costs due to variations in healthcare provider availability, cost of living, and insurance market dynamics. Understanding this connection is essential for individuals seeking to optimize their healthcare expenses.

- Healthcare Provider Availability: The number and proximity of healthcare providers, specialists, and hospitals in a region influence insurance costs. Areas with limited healthcare access may have higher premiums due to the scarcity of services and increased competition among insurers.

- Cost of Living: The overall cost of living in a location, including housing, transportation, and goods, impacts insurance premiums. Insurers consider the cost of healthcare services and administrative expenses when setting premiums, which can vary significantly between urban and rural areas.

- Insurance Market Dynamics: Competition among insurance providers within a region can affect premiums. Areas with a higher concentration of insurers may have lower premiums due to increased competition. Conversely, areas with limited insurance options may have higher premiums due to reduced competition.

Recognizing the connection between location and health insurance costs empowers individuals to make informed decisions about their coverage and financial planning. By considering the healthcare provider availability, cost of living, and insurance market dynamics in their location, individuals can select appropriate coverage options and explore strategies to manage their healthcare expenses effectively.

Coverage

Understanding the connection between coverage and health insurance costs is crucial for optimizing healthcare expenses. The type and extent of coverage, including deductibles, copays, and coinsurance, significantly impact the overall premium costs.

- Deductibles: A deductible is the amount an individual pays out-of-pocket before the insurance coverage begins. Higher deductibles generally result in lower premiums. However, individuals with higher healthcare needs may prefer lower deductibles despite the higher premiums.

- Copays: Copays are fixed amounts paid by the insured for specific healthcare services, such as doctor’s visits or prescription drugs. Plans with lower copays typically have higher premiums, while plans with higher copays have lower premiums.

- Coinsurance: Coinsurance is a percentage of the healthcare costs that the insured pays after meeting the deductible. Higher coinsurance percentages lead to lower premiums, while lower coinsurance percentages result in higher premiums.

- Out-of-pocket Maximum: The out-of-pocket maximum is the yearly limit on the amount an individual pays for covered healthcare expenses. Plans with lower out-of-pocket maximums generally have higher premiums, while plans with higher out-of-pocket maximums have lower premiums.

By carefully considering the type and extent of coverage, individuals can make informed decisions about their health insurance plans. Balancing premium costs with potential healthcare expenses and personal financial situations is essential for selecting the most appropriate coverage option.

Provider

The choice of insurance provider significantly impacts health insurance costs due to variations in administrative costs, provider networks, and profit margins. Understanding this connection is essential for individuals seeking to optimize their healthcare expenses and secure the most appropriate coverage.

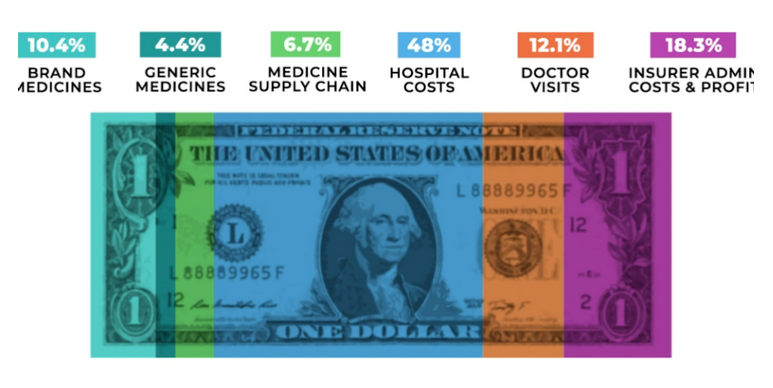

- Administrative Costs: Insurance providers incur various administrative expenses, including marketing, customer service, and claims processing. These costs are factored into premium calculations, leading to variations in premiums among providers.

- Provider Networks: Insurance providers contract with different healthcare providers, forming their provider networks. The size and quality of these networks influence premiums. Providers with more extensive networks may offer lower premiums due to their negotiating power with healthcare providers.

- Profit Margins: Insurance providers are businesses that seek to generate profits. The profit margin, the difference between premiums collected and claims paid, varies among providers. Higher profit margins can result in higher premiums for policyholders.

- Company Reputation and Financial Stability: The reputation and financial stability of an insurance provider can also influence premiums. Providers with strong reputations and stable financial positions may charge lower premiums due to their lower perceived risk.

Recognizing the connection between insurance providers and health insurance costs empowers individuals to make informed decisions about their coverage. Comparing premiums, provider networks, and financial stability among different providers allows individuals to select the most suitable insurance plan that meets their healthcare needs and financial constraints.

Health status

Understanding the connection between health status and health insurance costs is crucial for individuals seeking comprehensive and affordable healthcare coverage. Pre-existing conditions and high-risk factors significantly influence premium calculations, impacting the overall cost of health insurance.

- Pre-existing Conditions: Individuals with pre-existing medical conditions, such as chronic illnesses or genetic disorders, may face higher premiums. Insurance companies assess the potential risk and healthcare costs associated with these conditions when determining premiums.

- High-Risk Factors: Certain lifestyle factors or family history can indicate an increased risk of developing health issues. Tobacco use, obesity, and a family history of certain diseases can lead to higher premiums due to the anticipated higher healthcare utilization.

- Impact on Premiums: The presence of pre-existing conditions or high-risk factors can result in higher premiums to cover the potential costs of future medical expenses. Individuals with complex medical histories or a higher risk profile may need to pay more for health insurance.

- Implications for Coverage: In some cases, pre-existing conditions may affect an individual’s eligibility for certain health insurance plans or lead to exclusions or limitations in coverage. Understanding these implications is essential for informed decision-making.

Recognizing the connection between health status and health insurance costs empowers individuals to plan their healthcare expenses effectively. By considering their medical history, lifestyle choices, and family health history, individuals can anticipate potential premium variations and explore strategies to manage their healthcare costs.

Employer contribution

Understanding the connection between employer contributions and health insurance costs is crucial for employees seeking affordable and comprehensive healthcare coverage. Employer contributions play a pivotal role in determining the overall cost of health insurance for employees.

In employer-sponsored health insurance plans, the employer typically pays a portion of the premium, reducing the financial burden on employees. The amount of the employer’s contribution varies depending on factors such as company size, industry, and collective bargaining agreements.

For employees, understanding the employer’s contribution and its impact on their health insurance costs is essential for informed decision-making. A higher employer contribution can result in lower monthly premiums and overall healthcare expenses for employees. This, in turn, can provide greater financial flexibility and peace of mind, knowing that a significant portion of the health insurance costs is covered by the employer.

Recognizing the connection between employer contributions and health insurance costs empowers employees to make informed choices about their healthcare coverage and financial planning. By considering the employer’s contribution, employees can evaluate different health insurance plans, compare costs, and select the option that best meets their healthcare needs and financial constraints.

Government subsidies

Understanding the connection between government subsidies and health insurance costs is vital for low-income individuals and families seeking affordable healthcare coverage. Government programs like Medicaid and Medicare play a crucial role in reducing the financial burden of health insurance premiums and healthcare expenses.

Medicaid is a government-funded health insurance program for low-income individuals and families, providing comprehensive coverage for essential health services. Medicare, on the other hand, is a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities. Both programs aim to ensure access to quality healthcare for those who may not be able to afford private health insurance.

The availability of government subsidies significantly impacts the overall cost of health insurance. For those eligible, Medicaid and Medicare can substantially reduce or even eliminate monthly premiums and out-of-pocket expenses. This financial assistance empowers low-income individuals and families to secure the healthcare coverage they need without facing undue financial hardship.

Recognizing the connection between government subsidies and health insurance costs is crucial for individuals seeking affordable healthcare solutions. By understanding the eligibility criteria and benefits of programs like Medicaid and Medicare, low-income individuals and families can make informed decisions about their health insurance coverage and access essential healthcare services.

FAQs on Health Insurance Costs

This section addresses common questions and concerns regarding health insurance costs, providing clear and concise answers to help individuals make informed decisions about their healthcare coverage.

Question 1: What factors influence health insurance premiums?

Premiums are influenced by several factors, including age, location, type of coverage, health status, and insurance provider. Understanding these factors allows individuals to assess their potential costs and compare different plans.

Question 2: How does age impact health insurance costs?

Premiums tend to increase with age due to higher healthcare utilization and the likelihood of developing age-related health conditions. However, some plans offer age-based discounts or subsidies to mitigate these costs.

Question 3: Can I lower my health insurance costs?

Exploring options such as high-deductible plans, generic medications, and wellness programs can help reduce premiums and out-of-pocket expenses. Additionally, comparing quotes from multiple insurance providers and negotiating lower rates can lead to cost savings.

Question 4: Are there financial assistance programs for health insurance?

Government programs like Medicaid and Medicare provide financial assistance to low-income individuals and families. Additionally, some states offer subsidies and tax credits to help reduce health insurance costs.

Question 5: How can I choose the right health insurance plan?

Consider factors such as coverage needs, budget, and provider network. Comparing plans, reading reviews, and consulting with an insurance professional can help individuals select the most suitable option.

Question 6: What are the key takeaways regarding health insurance costs?

Understanding the factors that influence premiums, exploring cost-saving strategies, and utilizing financial assistance programs are crucial for optimizing healthcare expenses. Regular reviews and informed decision-making empower individuals to secure appropriate coverage while managing their financial.

Transition to the next article section: Understanding the intricacies of health insurance costs is essential for individuals and families. By exploring the key factors, strategies, and resources available, individuals can make informed decisions about their healthcare coverage, ensuring access to quality healthcare without undue financial hardship.

Tips to Manage Health Insurance Costs

Navigating the complexities of health insurance costs is crucial for individuals and families seeking optimal healthcare coverage. By implementing these practical tips, you can effectively manage your expenses and secure appropriate coverage.

Tip 1: Understand Premium Influencing Factors

Familiarize yourself with the factors that influence health insurance premiums, such as age, location, coverage type, and health status. This knowledge empowers you to assess your potential costs and compare different plans.

Tip 2: Explore Cost-Saving Strategies

Consider high-deductible plans with lower premiums and out-of-pocket expenses. Utilize generic medications to reduce prescription costs. Participate in wellness programs offered by your insurance provider to earn rewards and discounts.

Tip 3: Compare and Negotiate Plans

Obtain quotes from multiple insurance providers to compare premiums and coverage options. Negotiate with your current provider for lower rates or additional benefits. Explore group plans through employers or organizations to potentially secure better deals.

Tip 4: Utilize Financial Assistance Programs

Research government programs like Medicaid and Medicare that provide financial assistance to low-income individuals and families. Explore state-level subsidies and tax credits that may further reduce health insurance costs.

Tip 5: Review Plans Regularly

Regularly assess your health insurance needs and financial situation. As circumstances change, consider adjusting your coverage or switching to a more suitable plan. Staying informed ensures you optimize your healthcare expenses.

Summary

By implementing these tips, you can effectively manage health insurance costs and secure appropriate coverage that aligns with your healthcare needs and financial constraints. Remember to stay informed, compare plans, and explore cost-saving strategies to make well-informed decisions about your healthcare.

Conclusion

Exploring the intricacies of “how much does health insurance cost” reveals a multifaceted landscape influenced by various factors. Understanding these factors empowers individuals and families to make informed decisions about their healthcare coverage, ensuring they secure appropriate protection without undue financial burden.

By considering age, location, coverage type, health status, and insurance providers, individuals can assess their potential costs and compare different plans. Implementing cost-saving strategies, such as high-deductible plans, generic medications, and wellness programs, can further optimize healthcare expenses.

Utilizing financial assistance programs like Medicaid and Medicare can provide significant relief to low-income individuals and families. Regularly reviewing health insurance needs and coverage options ensures individuals adapt to changing circumstances and make informed choices.

Ultimately, understanding health insurance costs is paramount for navigating the healthcare system effectively. By staying informed, comparing plans, and exploring cost-saving strategies, individuals can secure appropriate coverage that aligns with their unique healthcare needs and financial constraints.